Loan Estimate Explained

The Loan Estimate is an informational document the mortgage company provides within three days of you completing a loan application. It has three pages, each providing a detailed disclosure about your loan.

It includes the interest rate you were quoted, the costs and fees associated with the transaction if your loan has a pre-payment penalty, your APR, and your monthly mortgage payment.

Origins of the Loan Estimate

If you purchased a home or refinanced a mortgage before October 2015, you’ll remember a document called the Good Faith Estimate (GFE) and another one called the Truth-In-Lending disclosure (TIL).

The GFE had your name, address, the interest rate you were quoted, costs and fees, and monthly payment. The TIL had your APR, total financed charged if your loan had a pre-payment penalty and if your loan is assumable.

In Late October 2015, federal regulators released a brand new document, the Loan Estimate (LE), to replace both the Good Faith Estimate and the Truth-In-Lending statement.1

Why Did They Make The Change?

Regulators at the Consumer Financial Protection Bureau (CFPB) decided that the GFE and TIL disclosures needed an overall. They were trying to find a way to reduce the number of disclosures a loan officer had to provide to a borrower. Reducing the number of disclosures would help reduce the confusion for borrowers.

The LE was a welcome change by the industry in general as it made it easier to explain the details of the loan to a borrower.

Do You have a question or need a quote?

Contact KevinLow rates, fast closings, and exceptional service.

When is the Loan Estimate sent?

A Loan Estimate is issued after a homeowner or potential homeowner applies for a new mortgage within three days of completing a loan application.2 It’s vital to know that if you call a lender for a quote and don’t complete a loan application, they will not send you a LE.

It’s also important to remember that the disclosure is just what it says it is: an “estimate.” The lender has to follow certain regulations and laws regarding the disclosure of all the costs, but there is some leeway provided in case something changes.

In addition to the initial LE given to the borrower at the time of application, a new LE is sent whenever there is a material change to the loan. For example, a new LE will be sent if you lock in your interest rate. If you change the terms of the loan amount, a new LE is issued.3

The Loan Estimate has three pages

Below is simple to read a breakdown of all three pages of the Loan Estimate.

Page One

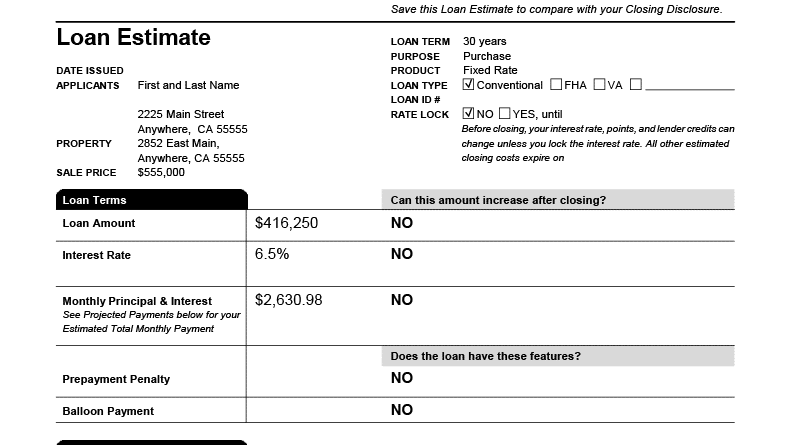

Page one of the Loan Estimate has five important points to cover.

- Mortgage rate (locked or not locked).

- Monthly payment (impounds or no impounds).

- Pre-payment penalty and balloon payment information (if applicable).

- Estimated closing costs and lender credits.

- Estimated cash to close or cashback to you.

Page one of the LE provides a wealth of information, and you should review it carefully. If you think your rate is locked, then the LE will reflect that.

And if you are getting a lender credit to cover some or all of the fees, it should be listed at the bottom of page one (towards the right of the page)

Don’t Miss The Top of Page One

One of the most important areas of the Loan Estimate is on page one, top right corner. It clearly spells out your loan term, purpose, loan product, type, and if the interest rate is locked. If you think the interest rate the loan officer quoted is locked, then look at the top right of page 1 and locate the “RATE LOCK” line.

If the box is checked “yes,” then your interest rate is locked, and it will list your lock expiration deadline. If it’s not checked or checked “no,” then your interest rate is not locked and can change before closing.

Please don’t just accept a verbal confirmation that the rate is locked; please ask for written confirmation. Per federal regulations, once the loan rate is locked, you should receive an updated LE within three days.

Page Two

Page two of the Loan Estimate is basically a breakdown of all the fees, credits, and impounds (if you are setting up impounds).

- Lender closing costs, including processing fees, underwriting fees, points, and origination fees.

- Third-party fees such as appraisal, title, and escrow fees.

- Government recording charges.

- Impound amounts (if applicable).

- And any other costs associated with the loan (i.e., pest inspection).

When you set up an impound account to pay your property taxes and insurance every month, it must be “pre-funded” with a certain amount. The total amount will differ for everyone, and the first LE may not have the exact/final amount listed (this is normal).

Important Details About Page Two

As mentioned, page two of the Loan Estimate has the breakdown of your fees, lender fees, third-party fees, and government recording fees, along with impound information (if you are setting up an impound account. It’s important to remember that the numbers listed in section G on page two (for impounds) are generic estimates at first.

Many lenders input three or six months of pre-funding for property taxes and insurance, but that could easily change by the time you move to close. Generally speaking, you might not get the exact number of months needed for pre-funding until after the loan is approved in underwriting (provided property tax and property insurance information is in the file when it’s reviewed).

Page Three

I like to say that page three of the Loan Estimate has all the “legalese” wording. The good thing is that it’s laid out well and fairly easy to read.

- Lender and loan officer information at the top, including contact emails and phone numbers.

- A comparison chart.

- APR for the loan (the APR is the interest rate plus the costs of the new loan combined).3

- Lists your Total Interest Percentage (TIP).

- Additional information such as Assumption options, Late payment information, Servicing, etc.

- At the bottom, it has a signature line so you can confirm the receipt.

Taking the time to review and understand the LE is an important part of the mortgage process.

Further Explanation About Page Three

As mentioned, the A.P.R. is your interest rate plus the loan costs expressed as a rate. Some people get confused by the interest rate and the APR, which is understandable. Just remember that your interest rate is what your mortgage payment is based on, and your APR is your interest rate plus the fees you’re paying to do the loan.

Loan Estimate questions to ask your loan officer

Here is a good list of questions to ask your loan officer if you are buying a home or refinancing a mortgage.

- Is the interest rate locked?

- Are the third-party fees exact, or could these be adjusted before closing?

- Where is the lender credit listed? (ask if you are receiving one)

- Is the amount listed to set up an impound account final, or could there be adjustments to that amount?

- Can you please explain the difference between the interest rate and the APR listed on page three?

Asking good questions is a great way to ensure your loan closes quickly and closes at the terms you are expecting.

What doesn’t the Loan Estimate have?

Here is a list of information the Loan Estimate doesn’t have;

- The Loan Estimate will not tell you if you are getting a good rate.

- There is no information in the Loan Estimate that tells you if your fees are too high.

- You won’t find advice in the Loan Estimate.

- It won’t explain the purchase contract between you and the seller (if you are buying a home).

Do You have a question or need a quote?

Contact KevinLow rates, fast closings, and exceptional service.

Bottom line on the Loan Estimate

The Loan Estimate is a great tool to help borrowers understand the mortgage they are applying for. The details provided in the Loan Estimate are just that, an estimate. Knowing what is in the Loan Estimate will help you obtain the loan terms you want and will give you a clear understanding of your interest rate in terms of whether it is locked in.

Sources:

- New disclosures streamline the process – Consumer Financial Protection Bureau

- What is a Loan Estimate? – Consumer Financial Protection Bureau

- Look out for revised Loan Estimates – Consumer Financial Protection Bureau

- What is APR? Learn the Basics – Wells Fargo